Change is Coming, but What Does That Look Like?

Theories and opinions abound as to what the new administration really means to the economy broadly and to individual markets and businesses specifically — especially given the uncertain nature of today’s economy. What we wanted to delve into is how these uncertainties can influence operational strategies — to ensure that you have (better) levers in place to protect margins and ensure resiliency to disruption.

We certainly have plenty of signals as to what the future holds as this administration takes shape:

- First, the nominations to date have been consistent with campaign themes — meaning, there is a close relationship between words and deeds.

- Specifically, the nature of the nominated economic team suggests that stated priorities such as tariffs, tax reductions, and broad-based deregulation are likely.

- As an example, tariffs have already been suggested for Canada and Mexico as economic leverage to force them to take increased measures to solidify the borders.

Does this sound familiar? Tariffs were a major topic several years ago. Dig into our thoughts on tariff strategy to inform your business strategy.

What Should Businesses Be Focused on for the Road Ahead?

The most urgent of these is tariffs — as there is a straight line between tariffs and costs to businesses — whether or not they can pass along those costs. It’s worth noting that tariffs don’t need to be effective to be popular: recent studies show that when people and businesses have provable evidence that tariffs hurt their financials, they still support them. In other words, the push for tariffs is happening with or without prior evidence of them being ineffective to the domestic economy. Tariffs have had specific impacts:

- They either (a) raised costs to consumers and therefore negatively affected demand, and/or (b) eroded the margins for those unable to raise costs or withstand declining demand.

- They had negligible impact on increasing jobs, particularly manufacturing jobs, as the primary “threat” to employment is automation, which is a domestic dynamic.

- They reduced access and/or increased the cost of U.S. businesses selling into foreign markets that reciprocate with economic hurdles.

With every pun intended, this can be a tariff-ying reality to businesses that are dependent on international goods and unable to pass along costs without degrading revenue performance.

Business leaders are likely already developing scenarios and contingencies. And in that deck of cards should reside operational analytics that ensure two outcomes to strengthen the business:

- Reducing costs to protect margin but moving from “operations is good enough” to “operations is a competitive advantage.”

- Increasing operational agility and resiliency to efficiently respond to economic shocks out of your control.

And we will go one step further. Business leaders need tangible evidence that any operational investment would free up working capital and improve resiliency for the business. The business case needs to be seen before material investment takes place. Leaders simply can’t absorb more uncertainty.

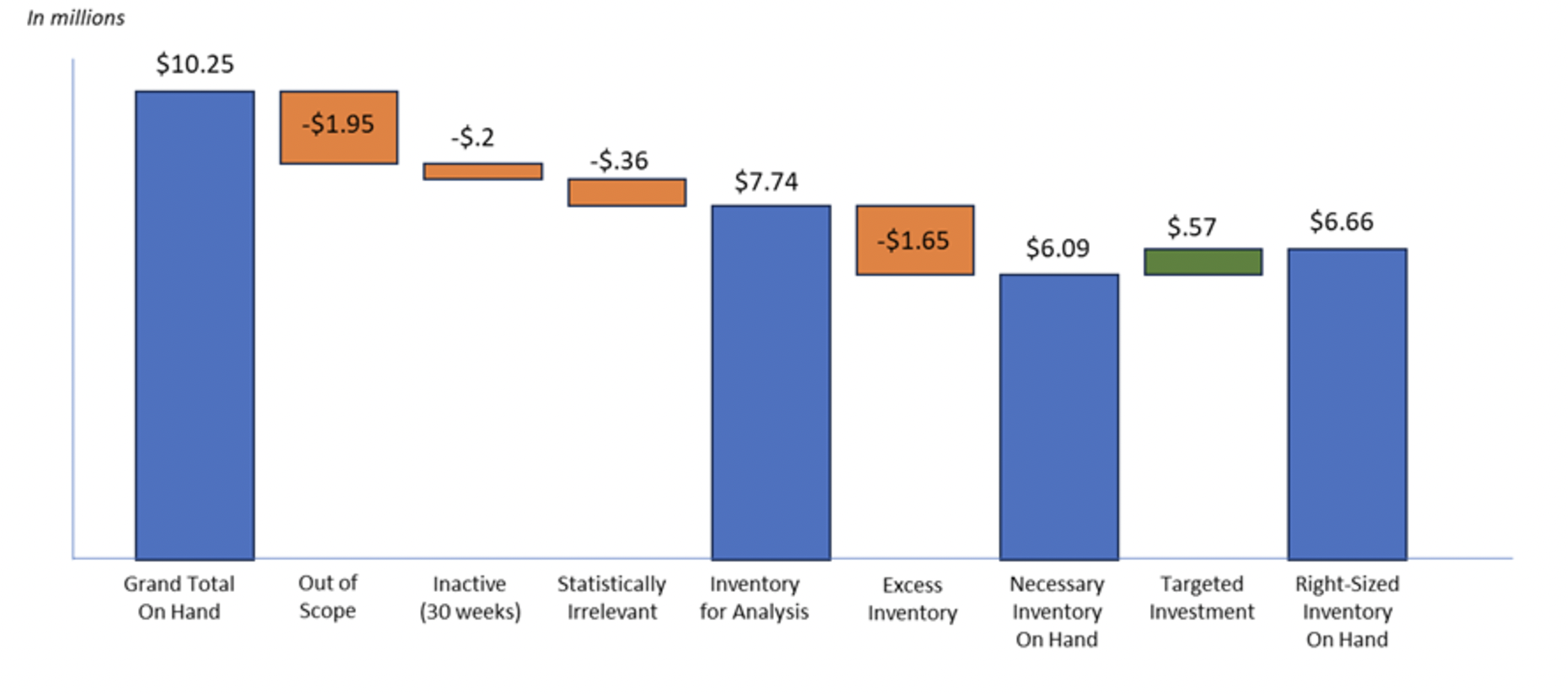

The chart below provides an example of what tangible evidence can look like: a clear set of levers able to provide a clear set of expectations (even where new investments are needed). In this example, the firm in question can expect a 35% reduction in inventory costs even with the $.57M investment included. Stated differently, this provides $3.59M of working capital back to the business while strengthening operations.

Know the Best Next Step with River Rock Advisors

Know the Best Next Step with River Rock Advisors

River Rock Advisors gives leaders the visibility and ability to strengthen financials and resiliency. Our RRApid Assessment assesses the different elements of operations, identifies levers, and projects the expected financial impact of changes — with the goal of producing a continuous stream of working capital back to the business and self-funding any significant changes.

About 11 years ago, River Rock Advisors started building around the core theme of balancing conflicting objectives of high customer service, low inventory working capital, and low costs — especially in challenging times. The current environment is an exciting time for us to support firms both in business and risk modeling and end-to-end value chain planning. Connect with us today to learn how we can make your operations function a competitive advantage for your business. Fill out the form below to connect with us.