Recent Institute for Supply Management PMI and Job Report readings remind us that forecasts for a soft landing didn’t fully describe what they meant by the word “soft.” Roughly 14% of the global economy is driven by US consumer spending. Any dent in consumer spending or confidence sends ripples around the world, as we saw in capital markets.

That shock wave had been building over the last several months as we have seen consumers increasingly trade down or trade out of prior spending habits, driven by the combined effects of higher prices, high borrowing rates, and increased debt. September’s expected rate cut will help, but it won’t cure this dynamic.

This was never going to be a smooth ride. But it was a useful reminder that each time the US consumer — and the broader economy — was deemed resilient, it may have meant that at least it didn’t crater. We are still in a fragile business climate in which companies operate against the backdrop of uncertain demand, a far more cost-conscious consumer, stubborn inflationary pressures, and a volatile geopolitical climate.

What Does Consumer Spending Impact Mean for SIOP?

Now, it may seem to be a bit of a leap to jump from macroeconomics to SIOP — but it’s not. Sales, Inventory, and Operations Planning (SIOP) is not simply good hygiene or a necessary response to operational woes. Instead, SIOP is a powerful lever to free up capital with neutral to positive impact to revenues. Done proactively (read: now), it enables you to get in front of any uncontrollable margin erosion and/or build reserves — all while strengthening operations.

One way to think about it is building muscle versus cutting into muscle if the economy further erodes.

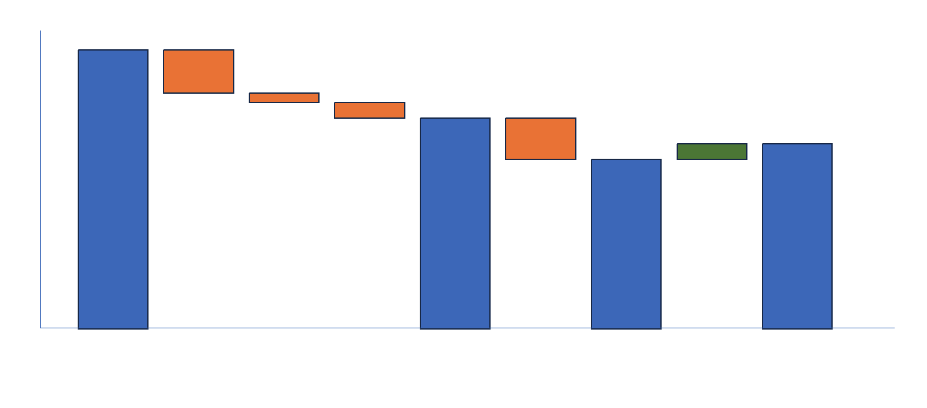

For example, recent work for a mechanical components manufacturer reduced inventory costs by 35% while improving service delivery. More than $3.6 million in previously wasted capital was now available for surgical investments to drive growth or reserves to protect margin.

This was not an anomaly or some edge case. These are predictable gains as companies uncover and address accumulated inefficiencies in the business.

Part of the message is that there are gains to be had that strengthen the business. The larger message is to do this now — proactively. It’s far better to do this work now and get ahead of any erosion in your sector.

And you don’t need to invest in SIOP without getting a good feel for what it can produce for you. Our RRApid Assessment enables you to be clear-eyed about the underlying issues to be tackled (and therefore at least the initial focus of the work), the investment needs, the expected gains, the likely timing of those gains — and thus the expected payback.

Let us know if this piques your interest, and we would be happy to connect and see what we can do for you.